Inside: Use these helpful strategies to avoid doom spending and make better financial decisions.

For many people, the last few years have brought increased financial stress and strain.

Inflation has increased prices, housing has gotten out of control, and incomes have not kept pace. People are left to try to figure out how to make it all work.

But what do you do when the math isn’t mathing?

For some people that means cutting back on the non-essentials. Giving up going out to eat, opting for less expensive items, or going without.

But for others? It looks more like doom spending. When the realities of life get tough, they ignore them and forge ahead as if nothing has changed.

Unfortunately that all catches up at some point and then they’re left trying to figure out how to dig themselves out of a hole and pay off the debt.

However, you’ll be much better off financially by skipping doom spending in the first place. Read on for more on what doom spending is and five helpful strategies to avoid doom spending so you can save more money.

What Is Doom Spending?

While some people have started simplifying and saving more to prepare for a recession, other people have responded in the opposite way.

With the frustration of increased prices and buying a home feeling out of reach, a number of people have taken to doom spending.

Doom spending is where you spend more money to deal with financial stress. It can look like splurging on items or vacations. That money that was being saved for a down payment on the house gets blown on a variety of items that weren’t needed but were fun to buy at the moment.

Some people are getting tired of waiting for the market to cool and feel that the future is uncertain so they’re choosing to spend while they can.

A recent survey found that 27% of people reported that they were doom spending to cope with stress. The majority of them are in their 20s to 30s but this is happening in other age groups as well.

This seize-the-day mentality is offering temporary comfort at a time when people are afraid of losing their jobs and are frustrated with the current state of the economy.

Unfortunately, these decisions to live outside their means can lead to even greater stress with an inability to pay the bills and very high-interest rates added to the mix.

A much easier solution is to avoid doom spending in the first place. Let’s look at five ways you can stay on track with your financial goals and avoid this pitfall.

5 Strategies to Avoid Doom Spending

Use these strategies to avoid doom spending and stay on track with your finances.

1. Do things other than shopping.

While browsing at stores might be fun, there are other activities to enjoy rather than shopping. Opting for other options will help to reduce the temptation to buy things you can’t afford.

Choosing other activities like going on a walk or having tea with a friend can have additional benefits for your health and overall well-being.

Doom spending is a very short-sighted decision. By thinking about what you truly need and would benefit your life, you can make a better use of your time and money.

Being intentional with shopping takes effort. Sometimes you need to simply avoid shopping altogether to keep from making purchases you’d later regret.

2. Wait to make purchases.

A great way to not doom spend is by learning how to avoid impulse purchases. Creating guidelines such as waiting a day (or a week) to make a purchase can help prevent making a decision you later regret.

By allowing yourself the time to process your options, you will be more likely to think clearly rather than getting caught up in the moment.

Because buying new things can give you an endorphin rush, it feels exciting. But that feeling is temporary and continuing that behavior can lead to having a shopping problem.

Consider what mechanisms are making it too easy for you to shop. Whether it’s apps on your phone, emails from your favorite stores, or having your credit card stored in apps or on websites, think of how you can make it more steps to make a purchase.

Will that be inconvenient at times? Yes, but the money you can save by having to be more intentional with your shopping will be worth it.

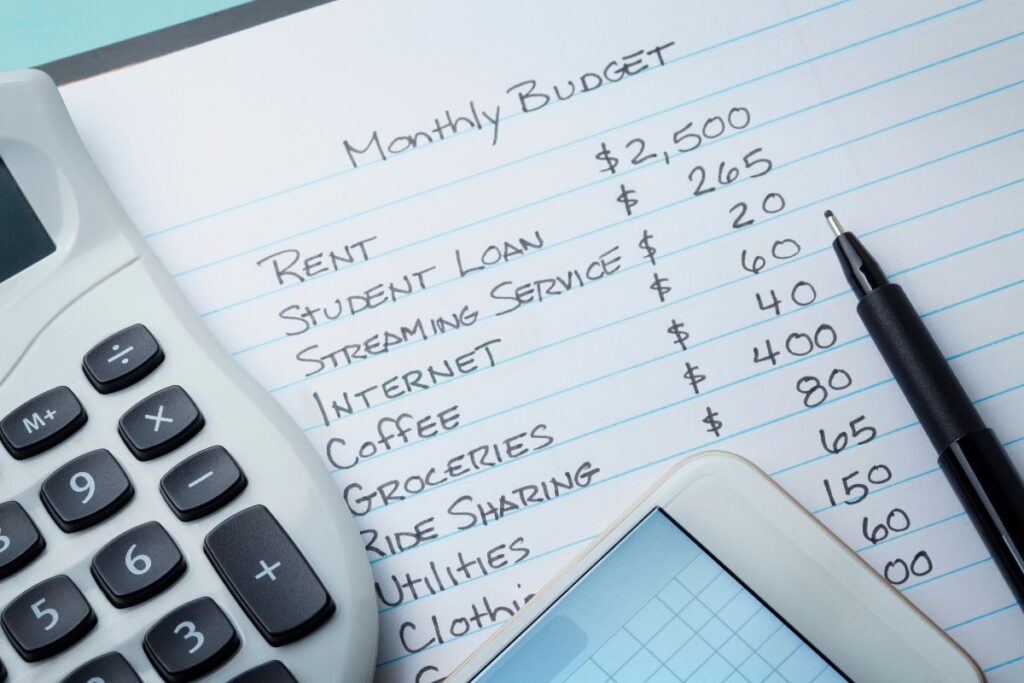

3. Create a budget.

If you don’t already have a budget, or you have one you’ve gotten off track from, now is a great time to review your numbers.

Would it be easier to hide your head in the sand? Yes. Does facing your purchasing habits feel painful at times? Also yes, but you can’t make changes until you understand the whole financial picture and get clear on your savings goals.

Paying attention to the numbers will help you regain control over your finances and can prevent money drains.

Setting your budget provides boundaries and helps you to make more informed decisions about what you do with your money.

4. Work through your fears.

As you consider how to avoid doom spending, it’s important to understand what emotions are driving the purchases.

Fear is an underlying emotion that can prevent decluttering progress and can keep you holding onto stuff as well as buying more of it. You can develop an unhealthy relationship with your things and it can become an even bigger source of stress.

Buying out of fear often has to do with a scarcity mentality. Perhaps the supply chain issues in recent years impacted how you felt about things. Or maybe the scarcity you’re focused on is the money you have coming in.

I recently heard a woman in the mall say to her friend, “I’m going to keep buying while my credit is still good.” When you fear financial ruin is around the corner it may make you more likely to make decisions that sabotage your spending. That type of behavior can create the exact situation you’re afraid of.

Retail therapy is not a good form of therapy. Buying as a way to deal with stress, cope with uncertainty or numb emotions is unhealthy and short-sighted.

Instead, opt to talk to a friend you trust, meet with a therapist, or spend some time meditating, praying, and/or journaling. Use tools that will help you to process your thoughts and feelings in a more productive way.

By dealing with your emotional clutter rather than spending more money and adding to it, you can avoid doom spending and get yourself to a healthier place.

5. Focus on gratitude.

Another great habit to have in your life and a way to avoid doom spending is by focusing on gratitude. By reflecting on what you’re grateful for, you’ll feel happier and be less likely to look for more stuff to fill a void.

You may even find that by simplifying you not only save more money but also feel more grateful for what you have.

So how do you focus on gratitude? There are many ways, but it can be as simple as making a habit of listing three things you’re grateful for each day.

It can also look like slowing down and noticing the simple joys in life. The more you intentionally focus on gratitude, the more things you will find to be thankful for.

Another great option is to start a gratitude journal. This not only helps you to reflect on what you’re grateful for but also gives you a written record that you can look back on later. Using gratitude prompts can help you to get started.

Creating a habit of gratitude in your life will help keep your focus on what you already have rather than looking for more stuff to add to your life.

How do you avoid doom spending? Let us know in the comments section below.

Sign up on the form below to get weekly decluttering and simplifying inspiration sent straight to your inbox. You’ll also get the free 8 Quick Wins for Decluttering Worksheet to help you start to simplify your life today.

I avoid looking at the sales ads whether they come in the mail, email, or text. I’ve been deleting them immediately because I realized that I don’t need to shop! It won’t feel good afterwards.

While reading this, I was inspired to remove my saved credit card information from shopping sites. It will take more effort to purchase which gives me more time to decided if I really need to spend that money. Thanks for the tips!

I avoid spending by following the one in one our rule. If I really like something but I don’t want to let go of anything I already have I don’t get it. Also, I try avoid targeted adds by not engaging with them. The more you click the more you will see.

I’m working on two words for the next year… ORDER and CONTENTMENT. And I’ve been memorizing Psalm 23

I balance my spending and budget daily. It takes just a few minutes because I do it so often and then spending can’t get out of control. I use an envelope method online budget program that keeps everything on track.

The best way that I have found to avoid frittering money away is to have written goals for my finances. Of course, a budget is helpful, but it is not a place for a list of long-term wants. This list has resulted in our eventually achieving a home of our own, good private education for our children, and our own building for my husband’s business. None of these happened overnight but one-by-one does get it done!